National Insurance Explained: How It Works & Contributions

Author

Louise Palfreyman

Assistant Payroll Manager

Reviewed By

Kevin Quinn

CEO

National Insurance is a payment you must pay to qualify for certain benefits and your pension. When you are over 16, you are automatically sent a National Insurance Number, which ensures your contributions are recorded against your name only.

At Payroll Solutions, we specialise in ensuring National Insurance contributions are correct throughout your payroll, so you can have peace of mind with full HMRC compliance. Our flexible solutions scale with your business, whether you operate locally or internationally.

In this guide, we explain how National Insurance works, including the different types of National Insurance classes and contributions.

What Is National Insurance?

National Insurance is a government system that funds state benefits, including state pension, maternity pay, unemployment benefits and the National Health Service (NHS). It is paid by employers, employees and self-employed individuals to ensure access to these benefits throughout their working lives and retirement.

Everyone over 16 receives a National Insurance Number, which ensures your contributions are recorded against their name. The amount you pay depends on your employment type and earnings.

For HR and finance managers, understanding National Insurance is essential for compliance, accurate payroll, budgeting and employee transparency. Mistakes can lead to HMRC penalties or incorrect employee benefit records.

At Payroll Solution Services, we verify National Insurance calculations within your payroll, ensuring accuracy, consistency and full compliance every time.

How National Insurance Contributions Work

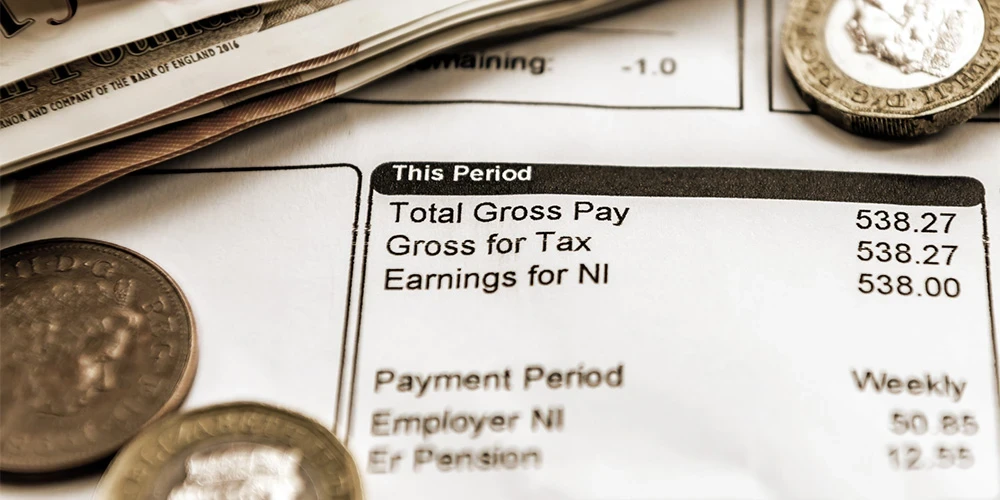

National Insurance contributions are deducted automatically through payroll and are based on earnings and employment type. Both employees and employers pay contributions, each at different rates and thresholds.

Employee Contributions

For employees, National Insurance is deducted directly from wages through the PAYE (Pay as you earn) system. The amount paid depends on salary levels and thresholds for the tax year.

For example, an employee earning an annual gross salary of £35,000 would calculate their National Insurance contributions by taking away the primary threshold first.

£35,000 - £12,570 (primary threshold) = £22,430

£22,430 / 12 = £1,869.16

£1,869.16 x 0.08 = £149.50

As an employee, based on these figures, you would pay around £150 per month in National Insurance for the 2025/26 tax year.

Employer Contributions

Employers pay an additional contribution on top of each employee’s gross salary.

For most employees, employers pay 15% on earnings above the secondary threshold. These payments help fund national benefits, such as pensions and healthcare.

Employers must calculate and report contributions to HMRC, each pay period. Incorrect calculations can lead to compliance risks and fines. Payroll solution services ensure payments are accurate and compliant every time.

The Different Classes of National Insurance

There are several classes of National Insurance depending on employment type and income level.

Understanding which class applies to each worker is essential for accurate submissions. In particular, in an organisation that employs a wide range of staff from full-time, part-time time and contracted staff.

| National Insurance Class | Who it’s paid by | When it’s paid | What it covers | Rate (2025/2026) |

|---|---|---|---|---|

| Class 1 | Employers and Employees | Through PAYE payroll | State benefits and pension | Employers 15% |

| Class 1A/1B | Employers | Annually on benefits and expenses | Employee benefits and expenses | 15% |

| Class 2 | Self-employed individuals | With annual self-assessment | Flat rate contribution for basic state pension and benefits | Fixed weekly amount of £3.45 (£179.40 per month) |

| Class 3 | Individuals (voluntary contributions) | Optional, paid directly | Fills gaps in contributions to qualify for the full state pension and benefits | £17.45 per week (Maximum you can pay) |

| Class 4 | Self-employed individuals | Paid via self-assessment | Based on business profits, it contributes to the state pension and benefits | 6% on earnings between £12,570 - £50,270 |

National Insurance Thresholds & Rates (2025/26)

Employers and employees both pay Class 1 National Insurance based on how much the employee earns. These contributions fund state benefits, including the state pension and NHS and are calculated based on employee earning thresholds each year.

Understanding these thresholds helps HR and finance teams plan payroll budgets accurately, stay compliant with HMRC and ensure employee contributions are calculated correctly.

Class 1 National Insurance Thresholds

Employees pay National Insurance automatically through the PAYE (Pay as you earn) system, depending on their gross earnings.

Lower Earnings Limit

The lower earnings limit is £542 per month, which is £6,500 per year.

Employees' earnings below this limit or the Primary threshold do not pay National Insurance, but they still get the benefits of paying; their record is still protected for state pension purposes.

Primary Threshold

The primary threshold is £1,048 per month, which is £12,750 per year.

Employees start paying national insurance at a standard rate of 8% when they reach this threshold.

Secondary Threshold

The secondary threshold is £96 per month, which is £5,000 per year.

Employers also contribute a standard rate of 15%.

Upper Earnings Limit

The upper earnings limit is £4,189 per month and £50,270 per year. Earnings above this amount are charged at an additional 2% rate for National Insurance.

Employers also contribute a standard rate of 15%.

Employer Thresholds and Rates

Employers pay an additional contribution on top of your employee's payment. The employer's contribution ensures access to your statutory benefits, such as sick pay, maternity leave and state pension.

Employers begin paying National Insurance once your gross salary has reached the secondary threshold, which for the 2025/26 tax year is £417 per month or £5,000 per year.

The employer contribution rate is 15% on all employee earnings above this threshold. Employers must calculate, report and pay their share of National Insurance to HMRC through the payroll process, each pay period.

Accurate calculations are essential as mistakes can result in compliance risks and financial penalties. Many organisations choose to outsource their payroll to ensure that all National Insurance contributions are processed correctly, securely and on time.

How Thresholds Affect Contributions

National Insurance thresholds impact both employers and employees differently, depending on salary and employment type.

For example, a part-time worker earning below the Primary Threshold pays no National Insurance but still builds entitlement.

A full-time employee earning £35,000:

Using the worked example above, a full-time employee who earns £35,000 would pay a class 1 standard employee rate of 8%, £150 per month in National Insurance.

Their employer would then contribute 15% on top of this, based on the salary of £35,000.

£35,000 - £5,000 (secondary threshold) = £30,000

£30,000/ 12 = £2,500

£2,500 x 0.15 = £375

The employer would contribute 15%, £375 per month.

A full-time employee earning £50,270:

If you’re in the upper earning limit, above £50,270, this is £4,189 per month. You would pay the class 1 standard 8% on earnings, with an additional 2% on earnings above the upper earnings limit.

£50,270 / 12 = £4,189 (Monthly earnings)

£4,189 x 0.08 = £335.12 (Standard 8% on National Insurance)

A full-time employee earning £60,500:

If you earned £60,500, you would pay the standard 8% on the first £50,270.

You would pay the standard 8% on earnings up to £50,270, which is £335.12 per month in National Insurance. With an additional 2% on top.

£60,500 - £50,270 = £10,230

£10,230 x 0.02 = £204.6 (2%)

Total £335.12 (8%) + £204.6 (2%) = £539.72

Their employer would then contribute 15% on top of this, based on their salary of £60,500.

A Self-employed individual earning £40,000:

A self-employed individual with £40,000 profit pays class 2 and class 4 contributions through self-assessment.

Would pay class 2, a fixed amount of £179.40 per month

Class 4, 6% on earnings between £12,570 - £50,270

£40,000 / 12 = £3,333

£3,333 x 0.06 = £199.98 (Class 4, 6%)

The total they would pay is £179.40 + £199.98 = £379.38.

Payroll Solutions Services ensures accurate threshold management and compliance, preventing under or overpayment.

National Insurance & Payroll Compliance

National insurance is a key part of payroll compliance. Every payslip, submission and HMRC report must align with the current National Insurance legislation. Payroll Solution Services ensures key compliance areas are accurately reported. This includes correct classification of employees and contractors, real-time HMRC submission, accurate pension and benefit reporting and GDPR compliant record keeping.

National Insurance compliance checklist for HR and Finance Managers:

- Verify the correct National Insurance category for each employee

- Check threshold rates are up to date

- Coordinate payroll reports monthly

- Ensure secure storage of employee data

- Submit RTI (Real-time information) to HMRC

Errors in National Insurance calculations can lead to financial penalties and damage to employee trust. Outsourcing payroll ensures compliance and accuracy, so you can be confident you are submitting a payroll that is accurate, secure and compliant, for peace of mind.

How Payroll Solution Services Can Help

At Payroll Solution Services, we make National Insurance management simple and stress-free. From accurate deductions and real-time HMRC submissions to full compliance monitoring, our experts handle every detail with precision.

We manage all National Insurance classes and payroll types, including complex multi-staff environments and contractors, ensuring complete accuracy, transparency and GDPR processing.

With dedicated account managers, secure systems and clear reporting, you gain complete confidence in your payroll compliance. Whether you’re a medium-sized business, large enterprise or managing CIS and self-employed staff, our tailored payroll solutions reduce admin, minimise risk and prevent costly errors.

Partner with Payroll Solution Services for streamlined National Insurance management and payroll management that grows with your organisation. We help you stay compliant, save time, and simplify National Insurance, so you can scale with confidence. Talk to our team of experts about your business today to find the right solution for your business.

Final Thoughts

Managing a large business or complex worker classifications can make payroll time-consuming and increase the risk of compliance issues and penalties as a result. At Payroll Solution Services, we specialise in accurate, compliant and flexible National Insurance management designed for fast-moving organisations.

We ensure every employee’s contribution is accurate, building accuracy and employee trust. Our scalable systems handle varied pay structures, timesheets and real-time reporting, giving HR and finance teams full visibility and control to manage costs effectively.

When partnering with Payroll Solution Services, you will benefit from full compliance, security and peace of mind, without the added pressure. With dedicated account managers providing consistent support, you can stay focused on growing your organisation with confidence.

Let’s talk about you

Let Payroll Solution Services manage your National Insurance calculations and HMRC submissions — so you can focus on growing your organisation.

FAQs About National Insurance

How is National Insurance calculated based on salary?

National insurance is worked out based on your earnings, with different rates applied to income based on specific thresholds. Part of your contribution is taken from your wages, while your employer also pays an additional amount into your total contribution.

What is the minimum salary to pay National Insurance?

For the 2025-26 tax year, employees start paying National Insurance contributions if they earn more than the primary threshold of £12,570 per year.

How many years of National Insurance contributions do I need for a full pension?

You need 35 years of National Insurance contributions or credits to qualify for your full state pension.

Is it worth paying voluntary National Insurance contributions?

Paying voluntary National Insurance contributions can boost your retirement income if you have gaps in your contribution record. However, the benefit of paying voluntary contributions varies based on your individual circumstances, so it’s important to review your National Insurance record and check calculations.

What age do most people stop paying National Insurance?

When you reach state pension age, most people stop paying National Insurance. If you’re self-employed, your Class 2 National Insurance contributions will no longer be treated as paid after reaching this age. You also stop paying Class 4 National Insurance at the start of the tax year, 6th April.

Author

Louise Palfreyman

Assistant Payroll Manager

CIPP accredited and backed by 10 years of payroll experience, Louise brings expert knowledge and precision to every aspect of payroll. With hands-on experience using multiple softwares, she ensures seamless migration onto our software. She oversees and ensures payrolls are processed accurately, on time, and in full compliance with current legislation. Louise is known for her attention to detail, problem-solving skills, and commitment to confidentiality and data integrity.

Reviewed By

Kevin Quinn

CEO

Kevin brings a wealth of experience in recruitment to Payroll Solution Services. Having witnessed firsthand the payroll challenges businesses face, Kevin identified a gap in the market and spearheaded the creation of a new venture dedicated to solving these very issues. His vision and leadership drive the company's mission to provide efficient and accurate payroll solutions, allowing businesses to focus on their core activities.